10 Best Strategies For Military Paydays

Military paydays can be a significant event for service members, as they often have unique financial challenges and responsibilities. Managing finances effectively is crucial for military personnel to ensure a stable financial future, provide for their families, and achieve their long-term goals. With the right strategies, service members can make the most of their paydays and set themselves up for success. In this article, we will explore the 10 best strategies for military paydays, covering topics such as budgeting, saving, investing, and more.

Understanding Military Pay

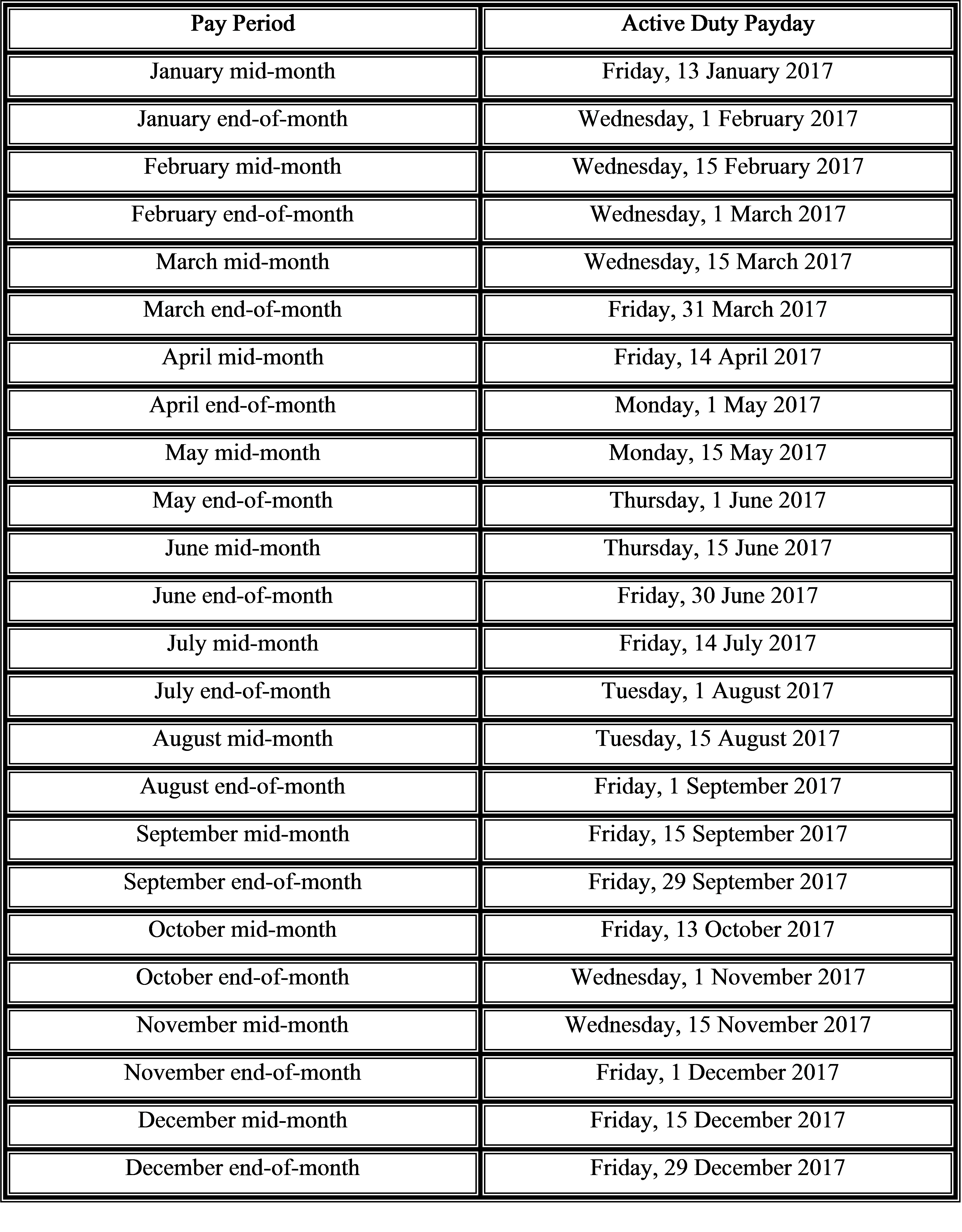

Before diving into the strategies, it’s essential to understand the basics of military pay. Military personnel receive their pay on the 1st and 15th of each month, with the amount varying based on their rank, time in service, and other factors. Basic Pay is the primary component of military compensation, and it’s the amount that service members receive for their time in service. In addition to Basic Pay, military personnel may also receive allowances for housing, food, and other expenses. It’s crucial for service members to understand their pay structure and how it affects their finances.

Creating a Budget

A budget is a fundamental tool for managing finances, and it’s especially important for military personnel. A budget helps service members track their income and expenses, identify areas for improvement, and make informed financial decisions. To create a budget, service members should start by tracking their income and expenses over a few months to understand their spending habits. They can then use the 50/30/20 rule as a guideline, allocating 50% of their income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

| Income Category | Percentage |

|---|---|

| Necessary Expenses | 50% |

| Discretionary Spending | 30% |

| Saving and Debt Repayment | 20% |

Strategies for Military Paydays

Now that we’ve covered the basics of military pay and budgeting, let’s dive into the 10 best strategies for military paydays:

- Automate savings: Set up automatic transfers from your checking account to your savings or investment accounts to make saving easier and less prone to being neglected.

- Pay off high-interest debt: Focus on paying off high-interest debt, such as credit card balances, as soon as possible to free up more money in your budget for savings and investments.

- Build an emergency fund: Aim to save 3-6 months' worth of living expenses in an easily accessible savings account to cover unexpected expenses and avoid going into debt.

- Take advantage of tax-advantaged accounts: Utilize tax-advantaged accounts such as the Thrift Savings Plan (TSP) or Individual Retirement Accounts (IRAs) to save for retirement and other long-term goals.

- Invest in a diversified portfolio: Invest in a diversified portfolio of stocks, bonds, and other assets to grow your wealth over time and achieve your long-term financial goals.

- Use the military's special savings programs: Take advantage of the military's special savings programs, such as the Savings Deposit Program (SDP), to earn higher interest rates on your savings.

- Consider a Roth IRA: Consider contributing to a Roth Individual Retirement Account (Roth IRA) to save for retirement and potentially reduce your tax liability in the future.

- Review and adjust your budget: Regularly review your budget and adjust it as needed to ensure you're on track with your financial goals and making the most of your military pay.

- Take advantage of military discounts: Take advantage of military discounts on everything from groceries to travel to reduce your expenses and free up more money in your budget for savings and investments.

- Seek professional advice: Consider seeking the advice of a financial advisor or planner who specializes in working with military personnel to get personalized guidance and advice on managing your finances.

Technical Specifications and Performance Analysis

When it comes to investing and saving, it’s essential to understand the technical specifications and performance analysis of different investment vehicles. For example, the TSP offers a range of investment options, including stocks, bonds, and target-date funds, each with its own fees, risks, and potential returns. Service members should carefully review the technical specifications and performance analysis of each investment option to make informed decisions about their investments.

| Investment Option | Fees | Risks | Potential Returns |

|---|---|---|---|

| Stocks | 0.05% | High | 8-10% |

| Bonds | 0.02% | Low | 4-6% |

| Target-Date Funds | 0.03% | Moderate | 6-8% |

Future Implications

The future of military pay and benefits is uncertain, and service members should be prepared for potential changes. One potential change is the implementation of a Blended Retirement System (BRS), which would combine elements of the traditional pension system with a defined contribution plan. Service members should stay informed about potential changes to the military pay and benefits system and adjust their financial plans accordingly.

What is the best way to manage my military pay?

+The best way to manage your military pay is to create a budget, automate your savings, and take advantage of tax-advantaged accounts and military discounts. It's also essential to regularly review and adjust your budget to ensure you're on track with your financial goals.

How can I save for retirement as a service member?

+As a service member, you can save for retirement by contributing to the Thrift Savings Plan (TSP) or an Individual Retirement Account (IRA). You can also consider contributing to a Roth IRA to potentially reduce your tax liability in the future.

What are some common mistakes service members make with their finances?

+Common mistakes service members make with their finances include failing to create a budget, not saving enough for retirement, and accumulating high-interest debt. It's essential to avoid these mistakes by creating a budget, automating your savings, and taking advantage of tax-advantaged accounts and military discounts.

In conclusion, managing military pay requires discipline, patience, and a well-thought-out strategy. By following the 10 best strategies for military paydays, service members can make the most of their pay, achieve their financial goals, and set themselves up for long-term success. Remember to stay informed about potential changes to the military pay and benefits system, and adjust your financial plans accordingly.