Complete Guide To Army Deployment Allowances

The United States Army is one of the most prestigious and respected institutions in the world, with a long history of bravery, honor, and sacrifice. For those who serve, the experience of deployment can be a challenging and transformative one, affecting not just the soldier but their entire family. To help mitigate the financial burdens that come with deployment, the Army offers various deployment allowances to support its personnel. In this comprehensive guide, we will delve into the world of Army deployment allowances, exploring what they are, how they work, and what soldiers can expect.

Introduction to Deployment Allowances

Deployment allowances are a form of financial support provided to Army personnel who are deployed to certain areas, typically outside of the continental United States. These allowances are designed to offset the additional costs associated with deployment, such as housing, food, and transportation. The goal of deployment allowances is to ensure that soldiers and their families are not financially disadvantaged due to the demands of military service. Understanding the different types of deployment allowances is crucial for soldiers to maximize their benefits and minimize financial stress. The Army offers several types of deployment allowances, including Basic Allowance for Subsistence (BAS), Basic Allowance for Housing (BAH), and Cost of Living Allowance (COLA).

Basic Allowance for Subsistence (BAS)

The Basic Allowance for Subsistence (BAS) is a monthly allowance provided to soldiers to help offset the cost of food. The amount of BAS varies based on the soldier’s rank and whether they are married or have dependents. For example, in 2022, the monthly BAS rate for an enlisted soldier was 369.39, while an officer received 289.18. Per diem rates also apply when soldiers are on temporary duty or deployed, which can be higher than the standard BAS rate. It’s essential for soldiers to understand how BAS works and how it can impact their overall financial situation.

| Rank | BAS Rate (2022) |

|---|---|

| Enlisted | $369.39 |

| Officer | $289.18 |

Basic Allowance for Housing (BAH)

The Basic Allowance for Housing (BAH) is another critical deployment allowance, designed to help soldiers pay for housing costs when they are deployed or on temporary duty. BAH rates vary based on the soldier’s rank, location, and dependency status. For example, a soldier deployed to a high-cost area like New York City may receive a higher BAH rate than one deployed to a lower-cost area like Oklahoma City. Understanding BAH rates and how they are calculated is vital for soldiers to budget effectively and minimize out-of-pocket expenses.

BAH rates are typically paid to soldiers who are living off-base or in private housing. The rates are adjusted annually to reflect changes in the local housing market. Soldiers can use online BAH calculators to estimate their BAH rate based on their location and rank. It's also important to note that BAH rates can be prorated, depending on the soldier's deployment status and location.

Cost of Living Allowance (COLA)

The Cost of Living Allowance (COLA) is a deployment allowance designed to offset the higher cost of living in certain areas, typically outside of the continental United States. COLA rates vary based on the soldier’s location, rank, and dependency status. For example, a soldier deployed to a high-cost area like Japan may receive a higher COLA rate than one deployed to a lower-cost area like Germany. COLA rates can be adjusted quarterly to reflect changes in the local cost of living index.

COLA is usually paid to soldiers who are deployed to areas with a high cost of living, such as Hawaii or Alaska. The allowance is designed to help soldiers maintain their standard of living, despite the higher costs associated with living in these areas. COLA rates can be significant, ranging from a few hundred to several thousand dollars per month, depending on the location and rank of the soldier.

Family Separation Allowance (FSA)

The Family Separation Allowance (FSA) is a deployment allowance designed to support soldiers who are separated from their families due to deployment or temporary duty. FSA rates vary based on the soldier’s rank and dependency status. For example, a soldier with dependents may receive a higher FSA rate than one without dependents. Family separation can be a challenging experience for soldiers and their families, and FSA is intended to help alleviate some of the financial burdens associated with this separation.

| Rank | FSA Rate (2022) |

|---|---|

| Enlisted | $250 |

| Officer | $300 |

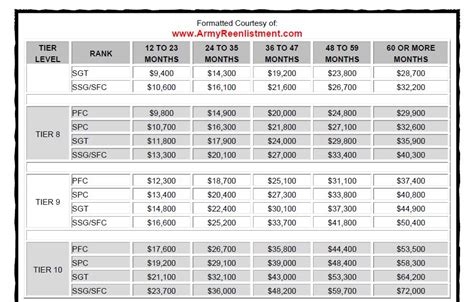

Performance Analysis

Deployment allowances can have a significant impact on a soldier’s financial situation, and it’s essential to analyze their performance to ensure they are meeting their intended purpose. Key performance indicators (KPIs) can be used to measure the effectiveness of deployment allowances, such as the percentage of soldiers who receive allowances, the average amount of allowance received, and the satisfaction rate among soldiers. By analyzing these KPIs, the Army can identify areas for improvement and make adjustments to the deployment allowance system to better support its personnel.

Technical Specifications

Deployment allowances are subject to various technical specifications, including eligibility requirements, payment schedules, and tax implications. Tax-free allowances, such as BAS and BAH, are not subject to federal income tax, while taxable allowances, such as FSA, are subject to tax. Soldiers must understand these technical specifications to ensure they are receiving the correct amount of allowance and to avoid any potential tax liabilities.

Technical specifications can also impact the way deployment allowances are calculated and paid. For example, the Army uses a complex formula to calculate BAH rates, taking into account factors such as housing costs, utility costs, and rental rates. Soldiers can use online tools and resources to help them navigate these technical specifications and ensure they are receiving the correct amount of allowance.

Future Implications

The future of deployment allowances is uncertain, and several factors could impact their availability and amount. Changes in government policy or budget constraints could lead to reductions in deployment allowances, while changes in the cost of living or housing markets could lead to increases. Soldiers must stay informed about these potential changes and plan accordingly to ensure they are prepared for any future adjustments to the deployment allowance system.

Additionally, the Army is exploring new ways to support its personnel, such as incentive pay and special duty pay. These programs are designed to recognize and reward soldiers for their service and sacrifices, and could potentially replace or supplement traditional deployment allowances. Soldiers should stay up-to-date on these developments and take advantage of any new opportunities that become available.

What is the purpose of deployment allowances?

+Deployment allowances are designed to offset the additional costs associated with deployment, such as housing, food, and transportation. They help ensure that soldiers and their families are not financially disadvantaged due to the demands of military service.

How are deployment allowances calculated?

+Deployment allowances are calculated based on a variety of factors, including the soldier’s rank, location, dependency status, and the cost of living in the deployment area. The Army uses complex formulas and data to determine the amount of allowance each soldier receives.

Are deployment allowances taxable?

+Some deployment allowances, such as BAS and BAH, are tax-free, while others, such as FSA, are subject to federal income tax. Soldiers should understand the tax implications of each allowance to ensure they are receiving the correct amount and to avoid any potential tax liabilities.