How To Plan Finances With Lt Col Air Force Salary

Planning finances is a crucial aspect of managing one's life, especially for individuals with a steady income, such as those serving in the Air Force. As a Lieutenant Colonel (Lt Col) in the Air Force, one's salary is substantial, but it requires careful planning to ensure that it is utilized efficiently. In this article, we will delve into the world of financial planning for Lt Col Air Force personnel, exploring the various aspects that need to be considered to make the most of their salary. Whether you are a seasoned veteran or a newly promoted Lt Col, this guide will provide you with valuable insights and practical tips to manage your finances effectively.

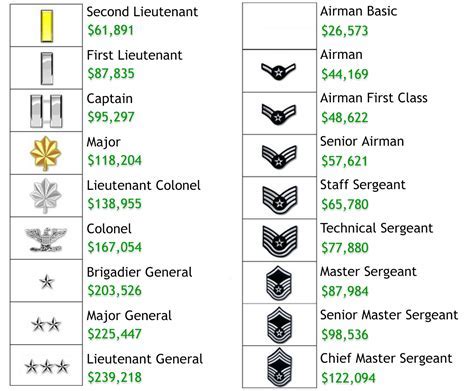

Understanding the Lt Col Air Force Salary Structure

The salary of a Lt Col in the Air Force is based on the military pay scale, which takes into account factors such as rank, time in service, and deployment history. The basic pay for a Lt Col in the Air Force ranges from 7,000 to over 12,000 per month, depending on the individual’s specific circumstances. In addition to basic pay, Lt Cols are also entitled to a range of allowances, such as housing allowance, food allowance, and clothing allowance, which can significantly impact their overall take-home pay. It is essential to understand the various components of the Lt Col Air Force salary structure to make informed decisions about financial planning.

Breaking Down the Lt Col Air Force Salary Components

To get a better understanding of the Lt Col Air Force salary, let’s break down the various components:

| Component | Description |

|---|---|

| Basic Pay | The monthly salary paid to Lt Cols based on their rank and time in service |

| Housing Allowance | A monthly allowance to help cover the cost of housing, whether on or off base |

| Food Allowance | A monthly allowance to help cover the cost of food, whether on or off base |

| Clothing Allowance | An annual allowance to help cover the cost of uniforms and other clothing items |

| Special Duty Pay | Additional pay for Lt Cols who perform specific duties, such as flight pay or hazardous duty pay |

By understanding the various components of the Lt Col Air Force salary, individuals can better plan their finances and make informed decisions about how to allocate their income.

Creating a Financial Plan as a Lt Col in the Air Force

Creating a financial plan as a Lt Col in the Air Force requires careful consideration of various factors, including income, expenses, savings, and investments. Here are some key steps to follow:

Step 1: Assessing Income and Expenses

The first step in creating a financial plan is to assess one’s income and expenses. This involves calculating the total monthly income, including basic pay, allowances, and any other sources of income. Next, it’s essential to track expenses, including housing costs, food, transportation, and other living expenses. By understanding where the money is going, Lt Cols can identify areas for cost-cutting and make informed decisions about how to allocate their income.

Step 2: Setting Financial Goals

Setting financial goals is a critical step in creating a financial plan. This may include short-term goals, such as saving for a down payment on a house, and long-term goals, such as retirement planning. By setting clear financial goals, Lt Cols can create a roadmap for their financial future and make informed decisions about how to allocate their income.

Step 3: Creating a Budget

Creating a budget is an essential step in managing one’s finances. This involves allocating income into different categories, such as housing, food, transportation, and savings. By creating a budget, Lt Cols can ensure that they are living within their means and making progress towards their financial goals.

Some key budgeting categories for Lt Cols to consider include:

- Housing: 30% of income

- Food: 10% of income

- Transportation: 10% of income

- Savings: 20% of income

- Debt repayment: 5% of income

- Entertainment: 5% of income

Investing and Saving as a Lt Col in the Air Force

Investing and saving are critical components of financial planning for Lt Cols in the Air Force. By investing in a diversified portfolio of assets, such as stocks, bonds, and real estate, Lt Cols can grow their wealth over time and achieve their long-term financial goals.

Understanding Investment Options

There are various investment options available to Lt Cols, including:

- Thrift Savings Plan (TSP): A retirement savings plan offered by the federal government

- Individual Retirement Accounts (IRAs): Tax-advantaged retirement savings accounts

- Stocks: Equity investments in publicly traded companies

- Bonds: Fixed-income investments in government or corporate debt

- Real estate: Investments in property, such as rental properties or real estate investment trusts (REITs)

By understanding the various investment options available, Lt Cols can make informed decisions about how to allocate their income and achieve their long-term financial goals.

Managing Debt as a Lt Col in the Air Force

Managing debt is a critical aspect of financial planning for Lt Cols in the Air Force. By paying off high-interest debt, such as credit card balances, and avoiding new debt, Lt Cols can free up more money in their budget for savings and investments.

Understanding Debt Options

There are various debt options available to Lt Cols, including:

- Credit cards: High-interest debt with flexible repayment terms

- Personal loans: Fixed-rate debt with fixed repayment terms

- Mortgages: Low-interest debt with fixed repayment terms

By understanding the various debt options available, Lt Cols can make informed decisions about how to manage their debt and achieve their financial goals.

What is the average salary for a Lt Col in the Air Force?

+The average salary for a Lt Col in the Air Force ranges from 7,000 to over 12,000 per month, depending on the individual’s specific circumstances.

How do I create a budget as a Lt Col in the Air Force?

+To create a budget as a Lt Col in the Air Force, start by assessing your income and expenses, setting financial goals, and allocating your income into different categories, such as housing, food, transportation, and savings.

What are some investment options available to Lt Cols in the Air Force?

+There are various investment options available to Lt Cols in the Air Force, including the Thrift Savings Plan (TSP), Individual Retirement Accounts (IRAs), stocks, bonds, and real estate.